On

June 20 to 22, Shanghai will host the China International Starch and Starch

Derivatives Exhibition. This event, which takes place annually, is the only

professional starch trade fair in Asia. The exhibition in 2017 will be the

twelve time of Shanghai welcoming experts and professionals from all over the

world in the starch industry to grab their chances in China’s fast-growing

starch market.

The

profile of China’s starch event will cover the segments of starch, modified

starch, starch sugar, fermentation products, starch derivates, and raw

materials for starch. Furthermore, the 2017 Global Starch Industry

Conference is going to take place as part of the event, which will focus

on the latest applications of starch and bio-based materials. After all, bio-based

materials are a worldwide focus of new materials, as well as an important field

of China's strategic emerging materials industry and biomass industry.

Developing environmentally-friendly and recyclable bio-based materials with

rich biological resources is of great significance to replacing fossil

resources, developing the cyclic economy, and building a resource-conserving

and environmentally friendly society.

Market

intelligence firm CCM gives an overview of the starch industry in China to

prepare attendees for the game-changing event in Shanghai. Make an appointment

with Kcomber, the parent company of CCM, at the exhibition by contacting econtact@cnchemicals.com.

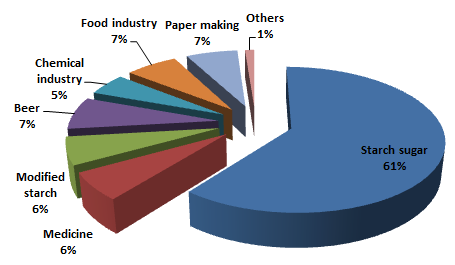

Downstream

sectors of the starch industry by consumption of starch in China, Jan.-Nov.

2016

Source:

China Starch Industry Association

Corn starch

China’s corn starch demand normally remains weak in the period of March to September

and starts to meet a peak period in October. Therefore, it is predicted that

corn starch price is less likely to rise significantly in the coming period,

due to the weak demand.

Notably,

the corn starch industry has been suffered from oversupply for a long time.

Corn starch output is likely to reach about 24.50 million tonnes in 2017, while

the demand might settle around 23.50 million tonnes. Furthermore, the growth of

output will even exceed the one of demand.

Besides,

corn starch still actively expanded production capacity. In 2017, many corn

deep processing companies increased capacity, with a combined rise of 10.70

million t/a, about 7.50 million tonnes of corn starch, according to the CSIA.

Nevertheless, constructing production lines in a short time means short

processing lines, which will result in structural overcapacity, a high degree

of similarity and low added value of products. CCM predicts that the corn

starch industry will still see overcapacity for a long time, especially with

the government's subsidy policy.

In

general, corn starch price fluctuates with the corn price. However, although

corn price continued rising in May in China, the corn starch price declined.

According to CCM's price monitoring, as of 13 May, the ex-works price of corn

starch amounted to USD298.60/t

SG

China's SG industry has faced significant integration in recent years. For example,

several domestic producers have expanded their capacities to seize larger

market shares and others have completely stopped their production because of

the environmental issue and fierce competition in the market. However, with the

entrances and exits of some players, the major producers of SG in China remain

concentrated in Shandong Province.

The

output of SG in China kept increasing in the past 5 years due to the positive

demand domestically as well as overseas. The prices of corn and corn starch

kept decreasing from 2015 to 2016, which benefited the corn processing industry

as well. In 2016, the output of SG in China reached 629,000 tonnes with a CAGR

of 7.59% from 2012 to 2016.

The

export of China's SG has been a rapid growth during 2012–2016. Stimulated by

overcapacity and fierce competition in the domestic market, China's SG

producers have paid more attention to the expansion of the overseas market,

while the low-price level of SG also beneficial for their business expansion.

Asia is still the major export destination of China's SG.

Concrete

additive, water quality steadying agent, food and electroplating detergent are

the major downstream products of SG in China. SG is mostly used in industrial

fields. Nearly 90% of SG is consumed in concrete additive. Benefited

from the increasing investment in infrastructure and real estate, the output of

commodity concrete in China increased year by year, creating a greater demand

for SG from 2012 to 2016.

Modified food starch

In

China, dairy products, as well as sauces, are the top end use application

fields of modified food starch, accounting for about three-quarters of the

total modified food starch sales volume by manufacturing giant Ingredion, in

2014 and 2015.

To

be more precise, dairy products used about 41,500 tonnes of modified food starch

in China in 2015, taking up 7.43% of the national total consumption. Dairy

products using modified food starch include yoghurt, milk beverage, and cheese.

Because of competition from overseas market, the output growth of China's dairy

products has been quite slow during 2013~2015 with a CAGR of only 1%. The

output in 2014 even dropped slightly over that in 2013.

The

largest consumption field of modified food starch in China have been noodles,

accounting for more than 38% of the consumption in 2015. Following have been

meat products with around 14% and candy with almost 11% of share. Other notable

consumption fields have been snack food, frozen food, dairy, and seasoning

paste.

Starch sugar

The

past two years has seen declining profits for China's starch sugar industry.

Firstly, competition among starch sugar enterprises was fierce, and secondly,

it is difficult to either market high value-added products or earn profits,

as prices of raw materials are low. To sum up, the starch sugar industry in China

is barely profitable now.

The

number of starch sugar enterprises in China has fallen from over 120 to only

107. Of the remaining enterprises. Moreover, industrial integration has taken

place in China's starch industry, contributing to the development of the market

and increasing industry concentration. That is to say, medium- and small-sized

starch sugar producers are gradually being replaced by large-sized ones;

outmoded capacity and enterprises which pollute the environment are to be

gradually eliminated.

Starch

sugar is mainly used in the food industry, especially in the beverage and

pastry industries. Given that the cane sugar price remains high and the starch

sugar price is low at present, replacing cane sugar with starch sugar seems the

more sensible choice. However, according to CCM's research, as of the end of

March, the sales/production ratio for sugar was 43.2%, vs. 40.3% in the same

period in 2015/16, which indicates that demand for starch sugar might be

sluggish in the future.

Recently,

researchers were substituting corn starch sugar for sugar to make ice cream. In

the last 6 months, the purchase price of sugar increased from USD738.18/t to

near USD1,033.45/t. In the meantime, the price of starch sugar declined from

USD354.32/t to USD295.27/t, due to the falling corn price. However, the

sweetness of starch sugar is not as high as sugar. The related person

also revealed that the cost of sugar takes up a large part of ice cream

production costs, and using starch sugar to replace sugar can reduce 35% of

production costs.

About CCM

CCM

is the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the starch market in China? Try our Newsletters and Industrial Reports or join our professional online platform today and get

insights in Reports, Newsletter, and Market Data at one place.

For

more trade information of starch products, including Import and Export analysis

as well as Manufacturer to Buyer Tracking, contact our experts in trade

analysis to get your answers today.

Meet

Kcomber at the exhibition on June 20 – 22. Please contact mailto:econtact@tranalysis.com.com for making an appointment.